Frequent Author and Quote Source: National Validation

2025 Thought-Leadership UPDATE: (1) On March 21, 2025, Tax Notes Federal published Tom’s ground-breaking, 6,283-word article addressing whether a local rule of a federal district court that requires a lawyer, even one who is hyper-qualified, to have, for a regular admission to the bar of the federal district court, an enrolled membership in good standing with the state bar of the state where the federal court sits. Sykes, “Are Most District Court Rules of Admission Invalid?,” 186 Tax Notes Federal 2217 (March 24, 2025). Tom believes that existing Supreme Court authority and 28 U.S.C. section 1654 require a holding that local rules with this structure violate Art. III and Amend. VI of the U.S. Constitution. These constitutional provisions appear to require federal admissions requirements to be based upon final adjudications by an Art. III federal court exercising Art. III powers, not upon final adjudications of a state bar applying state substantive and procedural standards. Tom’s recent article has been posted by the Standing Committee on the Rules Suggestions page of the U.S. Judicial Conference’s website with tracking numbers 25-BK-G, 25-CR-F, and 25-CV-I, respectively. (2) On May 16, 2025, Tom spoke at the 2025 Gem State Tax Symposium at Boise State University; he addressed the Supreme Court’s recent Loper Bright decision and its impact on the validity of Treasury Regulations challenged in federal tax disputes.

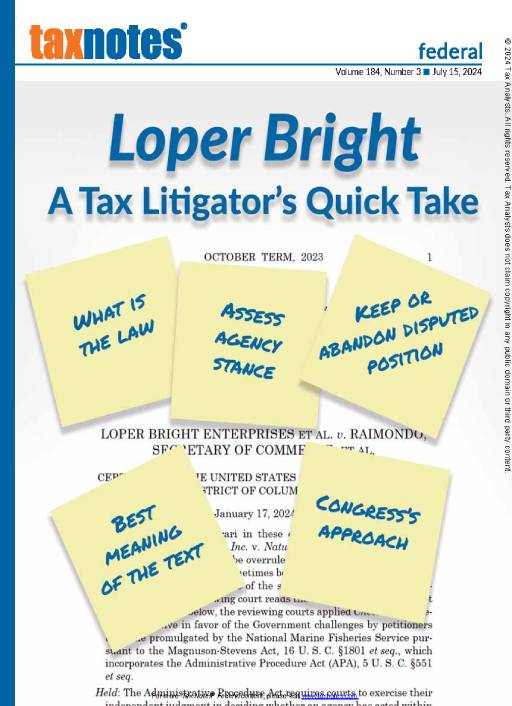

2024 Thought-Leadership RECAP: In 2024, Tom continued to make uncommon contributions to the intellectual life of the federal tax bar. His article on Loper Bright (see below) appeared on July 15, 2024, in Tax Notes Federal and Tax Notes International. Tax Notes is the world’s premier publication with articles of current interest to tax practitioners. His 5,000-word article, addressing a recent U.S. Supreme Court decision, was featured on the cover of Tax Notes Federal and later featured on Tax Notes‘ page on X (formerly Twitter). Shortly before that article appeared, Sykes appeared on a panel at the Federal Bar Association’s 39th Annual Insurance Tax Seminar, in Washington, D.C., to discuss the Supreme Court’s anticipated decision. In December, 2024, Tom was invited to speak about Loper Bright at a tax symposium in 2025. Loper Bright is the most important case for federal tax administration to come out of the U.S. Supreme Court in four decades, and Tom has been privileged to be at the forefront of the professional discussion. Tom is grateful for the two speaking engagements and for Tax Notes‘ elevation of his article.

- Tom has been quoted or mentioned by name in The New York Times, The Baltimore Sun, Tax Notes Federal, Tax Notes International, Tax Notes Global, Tax Notes Today, BNA Daily Tax Report, Tax Law360, International Herald Tribune, The Kansas City Star, Financial Advisor Magazine, Chicago Lawyer, Bloomberg.com, Crain’s Health Pulse, Forbes.com, and CNNMoney.com. Tom has published peer-reviewed litigation and tax articles across four decades (1980s, and 2000s through 2020s). Tax Notes, his most frequent venue, is the world’s leading tax publication.

- Author, “Are Most Federal District Court Admissions Rules Invalid?,” 186 Tax Notes Federal 2217 (March 24, 2025). Also posted by Tax Analysts on X (formerly Twitter). Note: Tax Notes is the nation’s premier source of tax-related news, analysis, and commentary.

- Author, “Loper Bright: A Tax Litigator’s Quick Take,” 184 Tax Notes Federal 451 (July 15, 2024) (cover story) and posted by Tax Analysts on X (formerly Twitter), July 20, 2024; and 115 Tax Notes International 309 (July 15, 2024). The article can be downloaded from Tax Notes page at the X website, having been designated by Tax Notes as a Special Report. An Associate Editor recently wrote that “the article has been one of our most-read pieces over the past three years — a true testament to the insight you brought to the topic.” (Loper Bright may be found at 144 S. Ct. 2244 (2024).)

- Author, “Are Needed Adjustments to Chevron Deference Coming?,” 181 Tax Notes Federal 1569 (Nov. 27, 2023), and Tax Notes Global (Nov. 29, 2023). Posted by Tax Notes on X, formerly Twitter (Dec. 2, 2023).

- Author, “New FinCEN Reporting Will Challenge Small Companies,” 174 Tax Notes Federal 149 (Jan. 10, 2022) and in Tax Notes State, Vol. 103, p. 149 (Jan. 10, 2022) (3,200-word article addressing new FinCEN filing obligations imposed by 2021’s Corporate Transparency Act). First article ever on impact of CTA upon the nation’s 30 million small businesses. Copy available upon request.

- Author, “The ‘Corporation’ Exception to Carried Interest: A Litigator’s View,” 169 Tax Notes Federal 769 (Nov. 2, 2020) (5,200-word article addressing Code section 1061(c)(4)(A)). Copy available upon request. In the wake of heavy lobbying by hedge funds and private equity, neither the Infrastructure Investment and Jobs Act (November 2021) nor the Inflation Reduction Act of 2022 (August 2022) “fixed” the taxpayer-helpful “error” in section 1061(c)(4)(A), despite advanced legislative proposals

- Quoted in Law360’s article on the Federal Circuit’s recent decision in Charleston Area Medical Center, which addresses Notice 2018-18 (respecting the TCJA’s cutback to the historically favorable treatment for Carried Interest)

- Quoted in Bloomberg/BNA’s article on the Federal Circuit’s recent decision in Charleston Area Medical Center, which addresses Notice 2018-18 (respecting the TCJA’s cutback to the historically favorable treatment for Carried Interest)

- Views as to the recent Charleston Area Medical Center decision, and its implications for the validity of regulations promised by IRS Notice 2018-18, addressed by Tax Analysts Contributing Editor Ben Willis’ LinkedIn blog

- Quoted in Law360, “Tax Docs Irrelevant to Interest Row, US Tells 10th Cir.” Jan. 9, 2019 (pertaining to new Code section 1061(c)(4)(A))

- Quoted in Bloomberg Law’s article, “IRS Clarification of Carried Interest May Face Legal Challenge,” March 22, 2018 (pertaining to new Code section 1061(c)(4)(A))

- Quoted in Tax Law360 on recent decision requiring the filing of administrative claims before suing to recover additional statutory interest, Oct. 22, 2016

- Author, “Litigation Finance for Tax Cases: A Win-Win for Taxpayers and Counsel,” 153 Tax Notes 713 (Oct. 31, 2016).

- Author, “10 Situations When a CPA Should Call ‘Timeout,’” Journal of Accountancy, April/May 2015. Use Google to view a copy.

- Author, “Additional Interest on FICA-Tax Refunds Made to Teaching Hospitals: Action Required,” hfma.org, October 2014

- Quoted in a profile of his practice published in Winter 2013 by the alumni magazine of Ohio State’s College of Law (ahead of the curve, Tom criticized giving Chevron deference to regulations)

- Author, “Ruling Favors Employer Tax Refunds on Layoffs,” CFO magazine, September 25, 2012

- Co-Author, “Could You Be Charged with A Crime for Failures by Prior Management to Pay Over Employment Taxes to the IRS?,” Orange County (CA) Business Journal, November 21, 2011

- Author, “De-Turbocharging Chevron and Mayo: What Arguments Survive Mayo to Place a Check on Federal Regulatory Overreach?,” Lexis-Nexis, April 27, 2011

- Author, “The Mayo Decision’s Problematic Tax Analysis,” BNA Daily Tax Report, March 17, 2011

- Author, “Time for Teaching Hospitals to Conduct a Strategic Review of Large-Dollar Claims Seeking a Refund of Medical-Resident FICA Taxes Paid Under the 2005 Regulation,” BNA’s Health Law Reporter, August 19, 2010

- Author, “Update on Next Steps for Teaching Hospitals to Recover FICA Tax Paid On Stipends Paid to Medical Residents,” Health Lawyers Weekly, June 18, 2010

- Author, “Recovering FICA Tax Paid on Resident Stipends: 2010 Update,” hfm Magazine, April 1, 2010

- Co-Author, “IRS Concedes That Medical Resident Stipends Are Not Subject to FICA Taxes for Quarters Before April 1, 2005: Now What?,” Health Lawyers Weekly, March 5, 2010

- Co-Author, “Navigating Voluntary Disclosure in the Wake of the Government’s Assault on Undisclosed Foreign Accounts,” The Criminal Litigation Newsletter, American Bar Association, Spring 2009

- Author, “Recovering FICA Tax Paid on Resident Stipends: Time for a Strategic Review,” hfm Magazine, January 2009

- Co-Author, “Deductibility of Bribes, Kickbacks, Illegal Payments, Fines, and Penalties,” Tax Management Portfolio 524 (BNA/Bloomberg treatise), 2007

- Co-Author of article about the intersection of tax and patent law, discussed in the New York Times by columnist Floyd Norris, October 20, 2006.

- Co-Author, “Whose Tax Law Is It?,” Legal Times, October 16, 2006

- Co-Author, “To Practice Tax Law, You Need A Patent License,” IP Law360, September 11, 2006

- Co-Author, “Chapter 3850: Examinations: Audits, Assessments, Appeals,” BNA/Bloomberg’s Tax Practice Series, 2005

- Co-Author, Supplement to major WG&L tax treatise regarding tax shelters (sub silentio).

- Author, “The Invalidity of Reg. § 1.903-1(a) — and a Tax-Recovery Strategy Suggested by the Analysis,” Journal of Taxation of Global Transactions, Winter 2004

- Author, “The Growing Controversy Over Federal Excise Tax on Long-Distance Calls,” The Tax Executive, May-June 2003

- Author, “The Invalidity of the ‘For Everyone or No One’ Rule and a Tax-Recovery Strategy Suggested by the Analysis,” Tax Notes, February 1, 2003

- Author, “Powerful New Arguments Against the Duplicated-Loss Provisions of the LDR,” Tax Notes, September 17, 2001

- Author, Student Note, “Chart v. General Motors: Did It Chart the Way for Admission of Evidence of Subsequent Remedial Measures in Product Liability Actions?,” 41 Ohio St. L. J. 211 (1980) (student-authored article in this Big Ten university’s flagship law review). Cited in ten other law reviews and by the Wisconsin Supreme Court.

Copyright Notice: All articles, including linked PDFs, are © by the author. All rights reserved.