Slide

Helping Clients and Seeking Justice

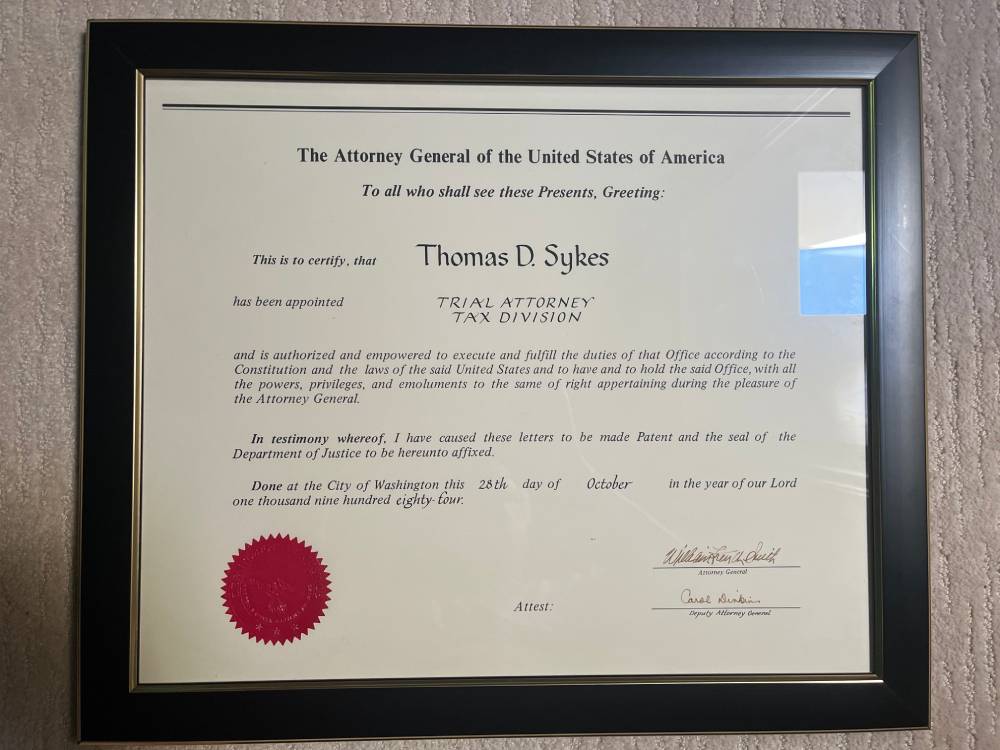

An ex-U.S. DOJ/IRS Lawyer with 40 Years of Top Experience Knows How to Help.

Reach Out Today

Slide

Initial Consultations, Call Today!

Maybe you have a dispute with the IRS or expect one. Tom, with a singular background, can help.

A Long Record of First-Chair, Top-Tier Tax-Dispute Accomplishment — Preferably Forged in the Federal-Court “Crucible” and National in Scope.

Judgment Seasoned by a Decade or More of Representing the IRS in Court, and then a Decade or More of Representing Blue-Chip Taxpayers against the IRS. Experience on “Both Sides of the Ball.”

Integrity- and Expertise-Based Credibility with IRS and U.S. DOJ Tax Authorities, and with Federal Courts.

And if the tax dispute has possible criminal overtones, a fourth quality is critical as well: Criminal-Tax Experience, Preferably as a Federal Prosecutor.

* * *

Having represented the IRS during the first half of his tax career, and having represented a plethora of blue-chip corporate, non-profit, and individual taxpayers during the second half …

Having first-chaired in court a vast array of complex and mega-dollar civil federal tax cases from coast-to-coast for 40 years at the very highest reaches of the tax profession …

Having tried over 20 cases to a jury verdict, having argued 16 cases to six different federal courts of appeals, and having written and filed hundreds of briefs in court …

Having been a federal prosecutor, with criminal tax and non-tax jury-trial experience …

Having been promoted twice into ascending, competitive-service supervisory positions (GM-15) with the Tax Division of U.S. DOJ in DC …

Having been, for more than a decade, a Tax partner or shareholder (without ever having been a (mere) associate) in two of the nation’s largest and most prestigious international law firms …

Having practiced for 18 years each in the “tax vortices” of DC and Chicago, first-chairing cases worth $3 to $4 billion — and now, since 2019, practicing federal tax law from Redmond/Bellevue, WA …

Having first-chaired federal tax cases controlling $500 to $600 million while practicing at his own solo law firm (started back in 2016) …

Having demonstrated a nimble intellect and thought leadership by publishing extensively in premier national tax and non-tax publications, including three authoritative commercial treatises, across four different decades (1980s, 2000s, 2010s, and 2020s) …

Having received over twenty coveted, formal awards from his lawyer peers in the “tax vortices” of DC and Illinois, across five different decades (i.e., 1980s, 1990s, 2000s, 2010s, and 2020s) … and

Holding a J.D. degree from a leading Big Ten, first-tier law school (where as a student he published an article in the law school’s flagship law journal — an extreme rarity for any student or practitioner) —

With all of this, Thomas D. Sykes may be your best choice to efficiently and effectively resolve your dispute with the IRS. He is not a bankruptcy, “business law,” divorce, estate-planning, probate, real-estate, immigration, or general-practice lawyer who dabbles in tax as needed; rather, he is a lawyer, at the top of his profession, who has focused upon intense federal tax disputes for the last 40+ years.

He will personally handle your dispute, and not hand some or all of it off to a junior partner, an associate, or a paralegal; this eliminates bureaucratic redundancies and fee duplication. His no-frills, quick-study, result-focused, “boutique” law firm offers judgment-informed solutions from energetic Redmond, WA — and emphatically not from Florida, Texas, California, or Michigan. His operating efficiencies allow his hourly rate to be well below the premium rate (2x plus) you would expect for a lawyer of this caliber.

Tom invites you to peruse this data-rich website (including its seven drop-down pages, its five click-on badges, three carousels, and several testimonials) for uncommonly specific details about Tom’s nationwide federal tax-dispute practice, and about his phenomenal, singular legal and tax background and experience. Then maybe use this web page as a checklist for comparisons, and . . .

Law Offices of Thomas D. Sykes PLLC

16625 Redmond Way Ste. M #151, Redmond, WA, 98052, US